Comparing Innovation Aviation and Aerospace to Other Industries - Part two: Aero vs. electro

This two-part article series has explored and compared how key innovations in the aerospace/aviation industries compare to the automotive market (part one) and the electronics/software industries (part two). Note that we consider communications as part of this electronics industry, since telecom and networking are wholly dependent upon semiconductor and electronics to drive data, and software to control it. We will also refer to these set of industries as the technology industry below. The intent of this article series is to identify several emerging technologies in disparate industries that cross over or influence aerospace products.

Can the Aerospace Industry Ever Regain Its Crown from the Electronics/Software Industries?

When aviation was young and the glamor of flight enchanted the world, entrepreneurs flocked to this nascent industry and rode the cycles of boom and bust. Fortunes were made and lost and none of this dissuaded thousands of start-up companies from launching new aircraft, components and services on a constant basis throughout the golden years of aviation. Then it happened … middle age … the time when you get more serious about yourself, your paycheck and your future. You take fewer risks, or at least you concentrate on measured ones instead. This is essentially where the current aviation and aerospace markets are today. This is not a negative situation, nor one that anyone would want to change, since air transport is one of the safest ways to travel due to this maturity of products, people and processes that make up the industry.

The electronics and software industries (which are nearly as tightly bound together as are aerospace and aviation) have long surpassed most other industries as the darlings of innovation (although the biotechnology and medical industries may have strong arguments against this). In fact, many of the recent key developments relating to aviation are dependent upon underlying solutions from the semiconductor, communications, networking, embedded software, sensor-related and memory storage industry niches, which were applied to aircraft-related applications. In fact, it might be a challenge to separate some of these advances and provide complete credit to one industry or the other. The automotive industry is just as dependent upon electronics, communications and software for many of its innovations as well, as is most every other major industrial sector today. In fact, the heart of all advances for most new products todays begins with electronics and software.

A recent report from the Boston Consulting Group (BCG), a global management consulting firm, studied the world’s “Most Innovative Companies” and few were aerospace firms. (Airbus and Boeing only ranked 33rd and 34th respectively, and GE was ranked 12th on the strength of its overall product line). In comparison, 21 of the 50 companies identified were part of the technology and telecom sector, including the top five positions. The study and its associated interactive chart are found at: www.bcgperspectives.com/most_innovative_companies.

There is undoubtedly much built-in bias toward the glamor of Apple, Google and other companies that focus on new ideas. However, the advances in technology drive nearly every other industry’s products and services, with few identified exceptions (material science, biofuels, batteries, and medical among others).

While a direct comparison between technology and aviation is not exactly an apples-to-apples evaluation, let’s throw caution to the wind and look at a few key recent innovations and how they compare to related efforts in air transport.

A Quick Look at Recent Innovations in the Technology

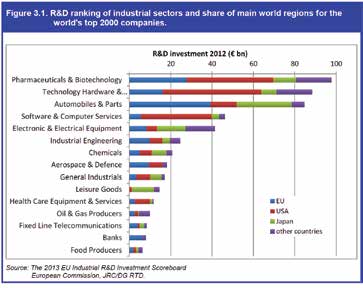

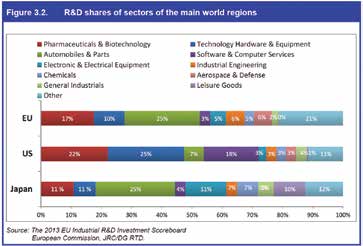

Modern electronics did not truly evolve until the invention of the integrated circuit in the late 1950s. This drove smaller and more reliable semiconductors and what we view as modern technology today. The global electronics industry outspends every other industry with the exception of the pharmaceuticals and biotechnology sector, as shown in the two charts from a recent study commissioned by the European Union — note that we are considering heavy overlap with technology hardware and equipment, software and computer services, and electronic and electrical equipment and how these three EU-categorized sectors are combined for the development of avionics, aircraft systems and related aviation support systems.

The charts above clearly show where innovation and research spending are being concentrated. They also show the regional disparities among national champion companies such as the biotech sector in the U.S. and the automotive sector in Japan and Europe. Interestingly, Japan ranked lower in technology hardware than the U.S., but as expected, was much higher in electronics. Europe also dedicates twice the amount of R&D to aerospace than the U.S. does, which is a surprising result. This might indicate how dependent the U.S. aerospace industry is upon the DOD for key R&D funding. Apparently U.S. investors are drawn more to higher returns in sectors that have more growth than aerospace.

Let’s touch on three sets of key technology (electronics, software and communications) developments and compare this to similar efforts in aerospace/aviation.

The ‘Internet of Things’ is Finally Emerging

According to Wikipedia, “the Internet of Things (IoT) is the interconnection of uniquely identifiable embedded computing devices within the existing Internet infrastructure. Typically, IoT is expected to offer advanced connectivity of devices, systems and services that goes beyond machine-to-machine communications and covers a variety of protocols, domains and applications. The interconnection of these embedded devices (including smart objects) is expected to usher in automation in nearly all fields.”

Basically, the idea is that any product or device that can be reached via any type of communications medium will be. This concept emerged back in 1999 and has only slowly started to become reality.

While it can be argued the original vision of the IoT has not yet been achieved, the same argument can be applied to any nebulous vision for emerging products in any industry. Let’s concentrate on the positives and see how the technology world’s IoT compares to the FAA’s NextGen. (It’s not a fair fight, but such is life.)

The NextGen effort formally launched in 2003 and is arguably partially rolled out with required infrastructure (GPS satellites, various communications and management systems, etc.) with which ADS-B-equipped aircraft will need to interface. Airlines and operators are lobbying the FAA to extend the looming 2020 deadline to upgrade aircraft with needed avionics. As of the time of writing this article, this has not happened yet (and the FAA is holding fast to this date despite industry protests).

In comparison, if we can lump together all efforts by the electronics and software industries to create an interconnected ecosystem where disparate devices speak to one another, the IoT has gone slightly further than the FAA (and it has a ~3+ year head start). We now have a number of smart roads that have all types of monitoring and control available in metropolitan areas (with much more to come), numerous types of industrial applications where sensors are being deployed. This deployment is throughout not only manufacturing processes (thus increasing quality and decreasing waste) but also in maximizing supply chains linked around the world with just-in-time inventory controls and ordering (to name a few laudable advancements) and a burgeoning medical monitoring environment where patients can be tracked remotely (saving time, cost and wasted resources). Companies can do more and track key processes and resources with less staff than ever due to tracking, monitoring, sensory and automated decisions systems, namely the IoT. As new advances continue to roll out with smarter sensors and processors, with better wireless communications and power management, this will further drive adoption of the IoT.

While a safety-first system such as NextGen does not compare to the use of consumer electronics for use in most homes, it does have strong ties to industrial processes, traffic management and medical monitoring. In some ways NextGen is further along due to its single purpose use case, so it can have a singular set of standards and central control by the FAA. However, the IoT is a mass of competing standards with thousands of use cases in nearly every aspect of human endeavor, and basically is emulating the Internet on a wireless scale with more devices supported, many of them with minimal computing capability. This make is more challenging to develop IoT solutions in general, not to mention in recovering costs related to product development as the state-of-the-art changes quickly.

In fact, NextGen is already obsolete before it reaches its formal rollout. It is a static solution that cannot easily accommodate new technology advancements. This might doom it to an early end, whereas the IoT will thrive due to constant change. Aviation cannot handle much change at any one time for reasons centered upon safety, but it needs to find a way to incorporate newer technologies at a faster rate. Perhaps the FAA can find a way to track and identify interesting IoT developments for incorporation into NextGen-related elements. One can only hope.

Wireless Electricity — Look, Ma, No More Wires

The first consumer wireless products launched were mostly power-mats for smartphones and these had some success. Now we have a wide swath of applications across multiple industries experimenting with this technology due to recent advances. This is mostly due to private industry efforts and research institutions such as MIT and WiTricity, its spinoff that is spearheading this movement. We have come a long way from Nikola Tesla trying to build towers to transmit power wirelessly back in the beginning of the 20th century.

We are finally on the verge of an evolutionary change in how power is provided to electronic systems. Due to highly resonant wireless power transfer technology, we can now use automatic wireless charging for future hybrid, all-electric passenger and commercial vehicles in any location that has this type of charging solution installed. (Examples include home garages, parking garages, fleet depots, shopping centers or gas/charging stations.) Toyota has already announced that in 2016 it will offer wireless charging on its next-gen (no relation to the FAA) Prius Plug In, and other manufacturers will announce similar capabilities shortly. This technology will also provide wireless charging for many other types of electric vehicles such as golf carts, specialty and industrial vehicles. Vehicles that support this type of solution will also support in-vehicle wireless charging for mobile devices while driving. This will, in turn, reduce the need for power cords by passengers, or for add-on devices sold into the automotive aftermarket.

Buildings that incorporate this technology will be not need to have physical wiring in all locations of a facility, thus potentially reducing building and maintenance costs. You will be able to deploy even more IoT sensors and solutions through which the need to bring power to each nook and cranny is minimized. Imagine being able to deploy security systems around the exterior of your house with no wiring needed, and add lights and appliances where you need them, not where it was possible due to electrical outlets. Have your cordless tools simply charge when not in use, not to mention phones, computers and tablets.

Imagine the possibilities for military use. Soldiers, vehicles, covert sensors, unmanned robots and drones, and a whole plethora of battery-powered devices will now be able to operate without the need for replacement batteries. They will just spend some time next to an area that supports wireless charging.

In comparison, aviation only has a few experimental all-electric aircraft, and has barely moved in its efforts to get greener — mostly by trying to utilize a 1920’s technology pioneered by Fischer and Tropsch, and which converts biomass to liquid fuel. This is a process in which a collection of chemical reactions converts a mixture of carbon monoxide and hydrogen into liquid hydrocarbons — basically making petrol from coal, gas or plants (the preferred greener choice that aviation is pursuing). With heavy funding from governments, a number of commercial flights have been made with a mixture of biofuels resulting from this process (and others) to prove the viability of these greener biofuels, but there is no widespread commercial use as of yet. With oil prices dropping like a rock as of late, it is doubtful that anyone will invest in this in a substantial way until it is economically viable to do so.

Back to wireless power. This will be big. Real big. It will take some time, perhaps even an entire generation, in order to move away from primarily using wired power in most use cases. With Toyota using this for the 2016 Prius and other commercial and military uses coming along swiftly, the slow adoption by aviation of alternate fuel sources is already trumped by the looming launch of wireless power. Aviation’s efforts to find alternate means of powering aircraft look ancient in comparison.

Smarter Chips — The Rise of Neuromorphic Chips (aka SkyNet)

AeroVironment has designed and built a tiny new quadcopter with partial funding coming from DARPA’s neuromorphic SyNAPSE project. This drone was six inches square, 1.5 inches high, and weighed 93 grams including the battery. The neuromorphic chip that controlled this drone used only 50 milliwatts of power (not much) and was able to process information from optical, infrared and ultrasound sensors as it flew between three rooms, essentially acting like some living beings.

Why am I mentioning this as an electronics industry innovation and not an aerospace innovation? Quite simply, this copter could not have been built without the use of a brain-like neuromorphic chip. These chips differ from the traditional chips of today that are based upon the ‘von Neumann architecture’ (this is your computer science history lesson for the day), which is essentially little-changed at its core of the years. A majority of computers today use this von Neumann architecture, which transports data back and forth between a central processor unit and memory chips in linear sequences of calculations. This is simpler than how a human brain processes data. The von Neumann method is good at running applications code or sorting through sets of numbers or data, but is not good at handling and understanding visual and audio information. This is where the new computing architecture based upon neuromorphic chip architecture provides a vast improvement, as shown in the table from the MIT Technology Review.

According to DARPA, “The vision for the Systems of Neuromorphic Adaptive Plastic Scalable Electronics (SyNAPSE) program is to develop low-power electronic neuromorphic computers that scale to biological levels. Current computers are limited by the amount of power required to process large volumes of data. In contrast, biological neural systems, such as the brain, process large volumes of information in complex ways while consuming very little power. Power savings are achieved in neural systems by the sparse utilizations of hardware resources in time and space. Since many real-world problems are power limited and must process large volumes of data, neuromorphic computers have significant promise.”

There are several companies experimenting with building these chips. The one used for the quadcopter test was supplied by the HRL Laboratories (aka, the Howard Hughes Research Labs, which is owned jointly by GM and Boeing). Qualcomm is also betting big on this as its existing patent portfolio is under attack and it could use something new. (China has threatened to fine it ~$1B for apparently overcharging on its licensing fees on phone chipsets that use its patents in Chinese firms.) If these new chips are able to learn faster, process various types of data faster and use less power, Qualcomm and others (like IBM) could control the guts of the next generation of mobile computing for years to come, as well as for other application areas (like transportation, industrial, medical, etc.).

Essentially, once the technical challenges are overcome in the much larger technology market for how chips are deployed, you can expect aerospace firms to rapidly incorporate neuromorphic-based CPUs into systems that need to acquire various external data and process them quickly (like navigation systems, weather tracking, etc.). Note that not all aviation-related systems would need to make use of such chips — only those that rely more on acquiring unstructured data and less on processing software applications to accomplish some function.

In this case, there is no comparison to any effort in the aerospace market, since aircraft and aviation support systems will be consumers of this chip. In fact, these neuromorphic chips cannot come quickly enough since they promise to increase the quality of many airborne, ground and satellite systems and the resulting data they will be able to provide with faster processing times and reduced power consumption needs. In fact, avionics, ground-based systems and airborne sensors with such capabilities might be a saving grace for NextGen and put off its obsolescence.

They More Things Change, the More Aviation Stays Nearly the Same

Aerospace and aviation are dependent upon government funding of new ideas, more so than the technology industry seems to be. In some ways this is a product of the maturity of the industry and its need for centralized control of air traffic management and related operational processes. In other ways, this seems to hold us back from reaching higher. Aviation could never use unproven products on a large scale due to safety concerns, so it is unfair to compare these two industries.

However, aerospace needs to find better processes to analyze, test and adopt newer technologies into its products at a faster rate. Aviation needs to not only streamline its many operational processes using technology better, but upgrade the capabilities of the FAA and other regulators to reflect modern needs. The march of progress never waits for any stragglers, and tired excuses that new technologies cannot be incorporated until they are fully mature (i.e., nearly obsolete) is simply an excuse for not doing anything, or, properly investing in the future. This is not a call to ignore safety and reliability — rather, it’s simply a call for the entire air transport sector to move faster, get streamlined and become more techno-savvy as an industry. Or we can just wait for China, India and others to show us the way in the coming years, since they are investing heavily in new technologies.

John Pawlicki is CEO and principal of OPM Research. He also works with Information Tool Designers (ITD), where he consults to the DOT’s Volpe Center, handling various technology and cyber security projects for the FAA and DHS. He managed and deployed various products over the years, including the launch of CertiPath (with world’s first commercial PKI bridge). John has also been part of industry efforts at the ATA/A4A, AIA and other industry groups, and was involved in the effort to define and allow the use of electronic FAA 8130-3 forms, as well as in defining digital identities with PKI. His recent publication, ‘Aerospace Marketplaces Report,’ which analyzed third-party sites that support the trading of aircraft parts, is available on OPMResearch.com as a PDF download, or a printed book version is available on Amazon.com.

John Pawlicki is CEO and principal of OPM Research. He also works with Information Tool Designers (ITD), where he consults to the DOT’s Volpe Center, handling various technology and cyber security projects for the FAA and DHS. He managed and deployed various products over the years, including the launch of CertiPath (with world’s first commercial PKI bridge). John has also been part of industry efforts at the ATA/A4A, AIA and other industry groups, and was involved in the effort to define and allow the use of electronic FAA 8130-3 forms, as well as in defining digital identities with PKI. His recent publication, ‘Aerospace Marketplaces Report,’ which analyzed third-party sites that support the trading of aircraft parts, is available on OPMResearch.com as a PDF download, or a printed book version is available on Amazon.com.